Buy to Let

Buy to let mortgage is a mortgage specifically for the purchase of a property you intend to rent out and not live in. These purchases are mainly for investment purposes and not to be used as your main residence.

Get prepared to be a landlord, check out our calculators and resources.

5 main questions you need to answer before applying for a BTL Purchase (+ Some bonus questions)

Main Questions

Bonus Questions

01

02

03

04

05

- 01

What size mortgage I can achieve & what will my monthly cost be?

- 02

What is the property rental income needed for me to get the mortgage amount I want?

- 04

How much money do I need to cover the deposit and all other purchase costs?

- 05

What documents do I need to provide to get my Mortgage?

06

07

08

09

- 06

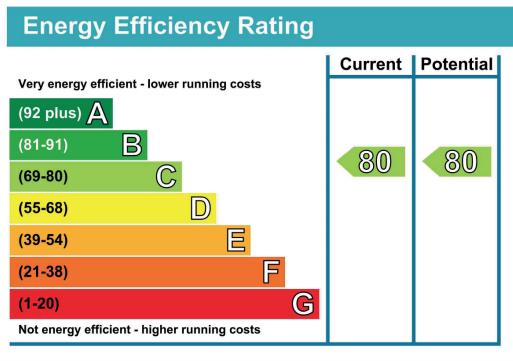

Does the property I'm buying have an up-to-date and valid EPC?

- 07

What is more important to me, paying off the mortgage balance or maximizing my monthly profit?

- 08

Should I purchase the Buy To Let property on a Limited company and how?

- 09

How can I build and keep track of my property portfolio?

Share!

Share on facebook

Share on twitter

Share on linkedin

Share on whatsapp

Share on email

Share!

Share on facebook

Share on twitter

Share on linkedin

Share on whatsapp

Share on email

Our Buy To Let Mortgage Calculators

We have a range of calculators to help make things simpler for you, from finding out how much you can borrow to calculating the impact of an interest rate change on your repayments. Have a go.

How much could I borrow?

Use the Buy To Let loan calculator to see how much you could borrow

How much rental income is required?

Use our Buy To Let rental requirement calculator to find out the minimum

rent is required to get the loan you want.

How much Stamp Duty will I pay

Use our Stamp Duty Calculator to see how much you could be paying in stamp duty.

Required Documents Checklist

Use our custom checklist to see what you should do before applying for your Buy to Let mortgage.

Offers from our partners

Frequently Asked Questions

What is a buy-to-let mortgage?

Buy to let mortgage is a mortgage specifically for the purchase of a property you intend to rent out and not live in.

Who are buy-to-let mortgages for?

Buy to let mortgages are for any property that is for investment purposes and not being purchased for your main residence.

How does a buy-to-let mortgage work?

This type of mortgage is based on different factors to a residential mortgage wherein the main factors for determining the loan amount are rental income from the property and also the property value. The higher the rental income the higher the loan amount able to be achieved.

Are buy-to-let mortgages interest-only?

No, you can get a buy-to-let mortgage on interest-only or a repayment basis but most buy to let property owner want to keep their costs low as to maximize profits. Therefore, paying just the monthly interest on the mortgage as opposed to interest and capital repayment works better because the owners retain more profits from the rental income.

What happens at the end of my interest-only buy-to-let mortgage?

If you choose to get an interest only mortgage at the end of your mortgage term you will still owe the principal amount that you initially borrowed. You would have to pay this off by either selling the property, paying off the principal loan and keeping your profits or re-mortgaging and taking out another loan to cover the outstanding principal amount borrowed.

What deposit do I need for a buy-to-let mortgage?

Typically, you should aim to have at minimum 25% deposit but there are some lenders that will lend up to 80% Loan to Value so that that would mean you would need a 20% deposit.

Is the stamp duty for a btl property more than for a residential?

Yes, with buying any investment property or a second home am or a buy to let property the stamp duty is higher than when you buy your main residence.

If I own a BTL property, do I have to declare and get taxed on the profits?

Yes, as well as the extra stamp duty you must pay which is around 3% more than when buying a residential property, you also have to declare the income that you make from your rental profits and pay tax on this profit as a part of your yearly income. This income is normally declared on your self-assessment when you are doing your yearly self-assessment tax returns under “Income from land or property” section. Also, when you sell the property, you will be liable to pay capital gains tax on the profits you’ve made from the property minus any allowable expenses and costs.

How many properties can I have before being classed as a portfolio landlord?

Four or more mortgaged buy to let properties would make you hey portfolio landlord. in order to get a buy to let mortgage most high street lenders will also require you to be classed as an “experienced landlord” meaning you would need to have owned a buy to let property or have received rental income for six months. Also, a lot of lenders require you to be an “owner occupier” of your own residential property first before they would allow you to qualify for a buy to let mortgage.